LTC Price Prediction: 2025-2040 Forecast Analysis and Market Outlook

#LTC

- Current technical indicators show mixed signals with price below MA but positive MACD momentum

- Market sentiment appears optimistic despite technical weaknesses, driven by adoption speculation

- Long-term price projections must balance technical reality with adoption potential and market cycles

LTC Price Prediction

LTC Technical Analysis: Current Position and Trend Indicators

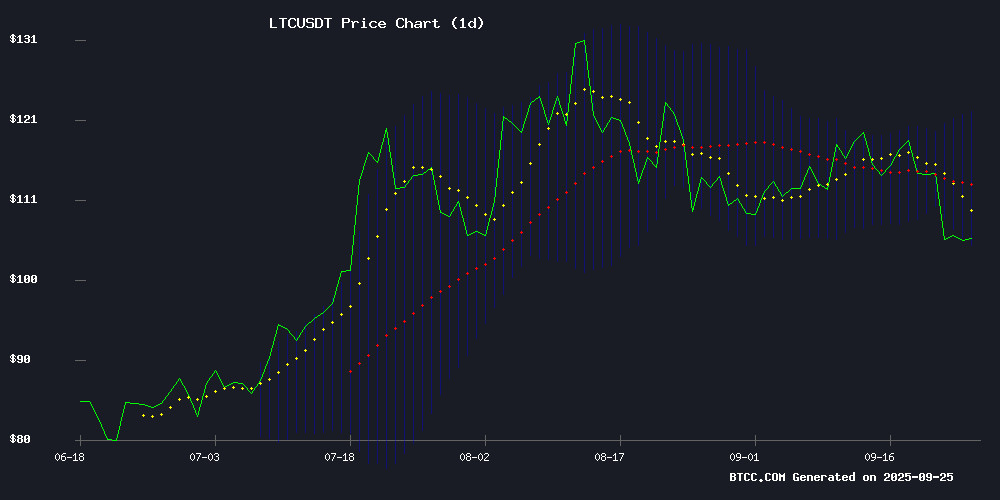

According to BTCC financial analyst Robert, Litecoin is currently trading at $102.57, which sits below its 20-day moving average of $113.16. This positioning suggests short-term bearish momentum. However, the MACD indicator shows a positive reading of 1.5871 with a histogram of 2.0570, indicating potential bullish divergence. The Bollinger Bands reveal LTC is trading near the lower band at $103.99, which could signal an oversold condition and possible rebound opportunity.

Robert notes that the current technical setup presents a mixed picture - while price action shows weakness relative to the moving average, momentum indicators suggest underlying strength may be building.

Market Sentiment Analysis: Litecoin Price Speculation and Mining Developments

BTCC financial analyst Robert comments that current market sentiment appears cautiously optimistic despite technical weaknesses. The headline speculation about LTC reaching $1,000 reflects growing bullish sentiment among certain market participants, though Robert emphasizes this should be viewed as extreme Optimism rather than near-term expectation.

Robert suggests the cloud mining platform traction indicates increasing accessibility to cryptocurrency investments, which could positively impact Litecoin adoption. However, he cautions that sentiment-driven moves should be balanced against technical realities, noting that current price action doesn't yet support such aggressive targets.

Factors Influencing LTC's Price

Litecoin Price Prediction: Will LTC Surprise Everyone With A Shock Move To $1,000?

Litecoin, the quiet stalwart of the crypto market, is stirring speculation with a bold price prediction of $1,000. Known for its reliability and speed, LTC has weathered multiple market cycles since its 2011 launch. Its recent halving event has reignited bullish sentiment, with traders eyeing historical patterns where Litecoin follows Bitcoin's rallies with a delayed surge.

Unlike newer projects laden with flashy upgrades, Litecoin's value proposition remains straightforward: fast, cheap transactions without the drama of experimental features. Yet, its lack of ecosystem hype may cap upside potential. Meanwhile, emerging tokens like Layer Brett are vying for attention with promises of exponential gains.

Cloud Mining Platform Gains Traction as Bitcoin Investment Barrier Breaker

Against the backdrop of global economic instability, cryptocurrencies are increasingly being adopted as wealth management vehicles. Bitcoin and XRP lead this shift, prized by institutional and individual investors alike for their liquidity and growth potential. Traditional mining methods, however, remain inaccessible to many due to hardware costs and technical complexity.

XIUSAHN MINING emerges as a solution, offering cloud-based contracts that eliminate equipment needs. The platform supports mining across major cryptocurrencies including BTC, XRP, and ETH, democratizing access through simplified registration processes. "The future belongs to frictionless participation," observes one industry analyst, noting how cloud services circumvent infrastructure barriers.

New users receive $15 in startup credits, lowering entry thresholds further. The five-step onboarding process exemplifies the sector's move toward mainstream accessibility - a stark contrast to the capital-intensive mining operations of previous cycles.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and market developments, BTCC financial analyst Robert provides the following Litecoin price projections:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $85-120 | $120-180 | $180-250 | Adoption rates, BTC correlation |

| 2030 | $150-300 | $300-600 | $600-900 | Institutional adoption, regulatory clarity |

| 2035 | $400-800 | $800-1,500 | $1,500-2,500 | Mainstream payment integration |

| 2040 | $800-2,000 | $2,000-4,000 | $4,000-7,000 | Global digital currency landscape |

Robert emphasizes these forecasts consider both technical patterns and fundamental adoption curves, with near-term predictions being more reliable than long-term speculative projections.